How We Teach Kids About Money

These kids of ours started their first real business ventures this summer and after sharing, I got a few questions on Facebook about what our kid’s ‘opportunity account’ is. I decided it was time for me to write down our general financial efforts when it comes to how we teach our kids about money. We have two kids, Hazel, who is 9, and Miles, who is 7. In no way do I feel that what we do is the right choice for everyone. I also don’t think it’s a bad way to go. I share it now to give it some structure and invite you to commandeer any parts you like.

The short answer is that their “opportunity account” is a name we call their normal old savings account. It’s similar to a college savings account but with a different philosophy entirely. Additionally, it isn’t something we parents add to, it is earned and gained by the kids existence alone. That said, currently it’s mostly made of family gifts but this summer is changing that. My ideas have changed over time, way back when Hazel was fresh I had written down my feelings here. This post is the next iteration of that.

The Philosophy

One of the things the hospital told be about, way back when I had my first kid was a 529 plan. It was new to me then and I very much do appreciate them telling me about it, even though we don’t use one. A 529 plan is a state sponsored college savings plan. Idaho is known for having one of the better 529 savings plans. It’s a plan where a person can stash money with various tax benefits for a designated beneficiary (their kid or grandkid usually) that can be used for almost any college expense including room/board/books/tuition and may incidental items along the way.

Way back then at the hospital, while holding my fresh little babe in my hands, I thought to myself, what if she doesn’t want to go to college, then what happens? It turns out that’s fine, she could withdraw it and just pay the taxes on it. But while the money is in the account it is in a low growth fund. I figured, we can do better than that on our own. Her money (which is mostly pre-taxed gifts from family, and would be taxed twice if she didn’t go to college) can be used to grow for her own benefit. Even if we just stuck it in a savings account it would do comparable. But in the meantime, we could use that money to teach her how to make money grow. We can’t do that if it’s just parked in a 529 account. And thus, our Opportunity Account was born.

OA

Not too long after they were born I set them each up a simple basic savings account. Most banks have youth accounts: slightly more interest, and kid targeted information/benefits. Once they had bank digits, and since we live in a small place, any birthday and holiday, the account numbers were shared for anyone who wanted to check the ‘get gift’ box but didn’t know what to get. It kept us from clutter and helped them develop little nest eggs for their financial training.

The rules of the OA

- Money can freely go in.

- It needs parent approval, or legal adult status to come out, and we’re not easy to convince. It has to be for something that will generate more money and it has to be replaced as soon as possible. These concepts are hard to get intuitively so when they express an interest, we discuss potential ideas.

- Half of everything earned by the kid goes in as a fact. The kids have no necessary expenses. They can afford to save half of their earnings. I feel that it’s helpful to learning how to live within your means in the future. I personally had some emergency situations come up in my young adult life and I don’t know how I would have made it through without that savings I built as a kid.

Inspiration

It was my own mother who made such a big deal about getting to the bank anytime we did a bunch of chores or earned a little money. I remember one time, I had almost five dollars to deposit. It wasn’t enough to make a special trip of it. I told my mom and she did not agree. We packed up, headed to the bank and filled out the deposit slip. I was a very shy kid overall but the bank was the only place I felt confident. At 10 I had over $1,200 in my savings account. The teller once said that I had a bigger balance than her and I can’t quite tell you how proud that made me. I felt competent. That’s a pretty good feeling as a kid. I try to do that for my own kids the same way my mom set that up for me.

The other side of the story

James has a different story than mine, sadly. He also remembers his folks helping him save. His parents also put money in their accounts for college. His folks tried the best they could but when he was a young teenager, his parents went through a divorce. Even though the kids saved a lot, the majority of the balances were put in by the parents and later became payments for lawyers. The kids’ accounts we unceremoniously cleaned out without them even knowing right away. The message sent was ultimately much different: If you don’t spend it, someone else might. There have been some lasting effects over this. It’s a sad conclusion that they have worked to overcome.

Because of this, we adults don’t deposit any money that would allow us ever to foresee justifying taking any out from their account. As the parents, we are both on the accounts but that money will never belong to us. We both feel very passionately about that.

So what is in the account and how is it making money

As the parent, my job is to steward their cash and make my best choices until they are old enough to loop in to the decision making. I also like to be hands off. They have been willed a few thousand and have very generous grand parents. Too much to just sit in a low interest savings.

Every so often I research rates and have put most of it in a high interest CD (certificate of deposit). At first that was a 5 year CD (longer time usually equals a higher rate). This year, our local bank ran a special for a 12 month CD at 5% so we moved it all over. The kids were a part of the process for the first time and learned about the early withdraw penalty and how to determine if it was worth it (it was). They are also excited about the $300 of interest their account will generate for them this year alone. We’ve been waiting for them to be old enough to learn how to grow it themselves and we are oh-so-close right now!

As they get older, we will stop storing it in a CD and use the funds to teach them about the stock market and other investment opportunities like crowd-lending, real estate and leveraging their own funding for their own ventures. Currently we do keep a couple hundred in a savings for access if they have an idea. That is what ultimately brings be to write this post right now, they have lofty goals for this summer!

But first, I want to talk about some of our other thoughts about kids and money.

Some (maybe shocking) feelings we hold:

- We’re not encouraging college.

- Our kids spend money freely, as much as it sometimes pains us when they waste it.

- We don’t make them do chores.

- We don’t pay an allowance.

- We do however pay them to read books.

Our ‘Whys’

No college?

I don’t think the financial world our kids will live in will be the same as the one we were trained (somewhat poorly at times) to exist in. They have YouTube, college isn’t always critical to get experience worthy of a career. I don’t even like the word ‘career’. I appreciate the long term struggle toward something but I think the human animal is happiest when we are allowed to do lots of different things at lots of different times. That’s probably a separate post though.

So you know, I can feel the eye rolls as I wrote that last paragraph and I still adamantly say it. Anything James and I have done that has been worth doing, we were taught from things like YouTube and independent blogs. Lifelong learning is the sweet spot, and education isn’t a box to check or something that has to cost a fortune or a future (loans). We both also have Masters degrees which gives us the experience of having student loans to pay back. Those are a long ago past for us because he (I didn’t actually have loans) prioritized paying off an extra $10,000 a year thanks to my nagged him so much. I wouldn’t even let him buy me a gift until he was debt free… I really don’t like debt. I certainly don’t love the idea of my kids going in debt for a degree. I also think the education is only appreciated if achieved on their own merits so I am not planning on paying for anymore degrees at this point in my life.

What if they want to be a doctor?

If they do decide that a college path is for them then we will absolutely rally to help that happen. That will include us researching their chosen career path with them, and helping them dig through scholarships and alternative financing options like employer funded school, military and various grants. And of course, they will still have their opportunity accounts to fall back on. I just don’t love the restrictions that come with many of the prepackaged ‘college funds’ because if I listen to my guts, I don’t hope that for them.

I also think the student loan industry is absolutely criminal, stacking baby adults with 5-6 figures of debt before they have fully developed brains and a life plan backed by experience. College is something to be enjoyed if you go, but it’s something to be very intentional about, too.

They spend

Half of everything they make, goes to their bank account. So if they want a $20 toy, they have to earn $40. And we don’t make that easy. Though James can tend to be pretty soft on them at times. Here are some always available jobs for them:

For his business, James ships out items. For that, he needs boxes which come flat and need folded. The kids have a standing deal that they can always fold boxes for their dad. He pays .05 a box. It takes them about an hour to fold 100. They can make about 5 bucks an hour that way and it’s an endless offer. I offer .25 to go feed the chickens and grab their eggs. If the windows need washing I pay .25 per window, but they have to get my approval. Otherwise we found out they will just wash windows whether they JUST did it or not… tricksters. For about two years we volunteered once a week at our local science center for two hours a day. Afterward, we’d stop by the grocery store on the way home. In exchange for their help volunteering they could either have 2 bucks or a treat (with a $1.50 limit) from the grocery store. They ALWAYS picked the treat.

Ultimately they can still be frivolous

Almost always the toys they want take a giant concerted effort to work for. Without exception, when they finally raise enough funds, they have decided that toy is probably not worth all of the time they used to earn the money. It feels better for them to have the 20 bucks than it would feel to have that item they wanted a month ago. The cycle has become that, once they have the money, they don’t want the original goal toy but then they see something else the DO want. They then impulse purchase that new thing because the cash is in hand. Then, also without exception, that toy looses luster. And they talk about how they wasted that money and should have waited it out a little.

Self imposed restrictions

Hazel is now at the age where she will put her own restrictions on purchases. I have always had this rule for myself, if I want something that is at the store that wasn’t on my list, I have to wait a day so I can sleep on it. I do this for $500 items and .50 cent items. I can drive back and in the next day and get it if I still want it but nine times out of ten, I don’t want it the next day. That other time, I don’t mind the drive back into town to pick it up. Hazel made a deal with me: she said she would like to start using the same rule, but since she can’t drive, she wanted my commitment that if she did want it the next day, I would drive her in. I agreed. Only once have I had to drive her back to town. For some fake fingernails that she nearly instantly regretted. She wore them proudly for 5 minutes before she decided they are really uncomfortable and impractical.

Which makes me wonder if I an ruining their joy

In that case, I worry that I am making them regret their purchases by being so frugal. And also that particular instance is my feelings about fake fingernails, I hate them. So, I had an open conversation with her that she can like different things than me and it’s ok to spend your money on things only because it makes you happy. There doesn’t HAVE to be any practicality to it. I needed her to know that I will love and celebrate her differences.

She said she didn’t regret the decision even though she didn’t like the nails. She just found out that wasn’t her style. She always wondered and now she knew and according to her, so it was worth the $13 to find that out. I think that’s pretty cool of her, using her own money to find out about herself. She made me agree that it was worth all the time it took to earn that.

Disappointment is a powerful tool

I think they need to feel disappointment sometimes and that comes from wasting their money. No matter how much I want to tell them that Kinder-eggs and LOL dolls are not worth it, they need to find that out on their own. And I am very happy to report that they ARE learning that because they have freedom to fail at financial decisions!

Another quick and humorous story about success by failure. We were just at the local renaissance fair and there was a tractor pulling around kids in half barrels in a makeshift train. The kids REALLY wanted to ride it. We searched for the loading zone and finally found it. We thought it was free and so Miles hopped on. He was all ready to roll and then the conductor said it was 5 bucks a ride. James TOTALLY would have paid for it so he could have the experience. He was pulling out his wallet when Miles yelled ‘Not worth it!’ and hopped off!

Hilarious, mildly embarrassing, and maybe a bit insulting, but gosh, I’m proud of that kid for protecting our money like he protects his own! He’s a good egg!

Chores

We don’t assign chores. We don’t even feel like we have all that much to do, we just have a flow and that’s a result of mine and James’s choices. For now, our kids willingly help how they can. I attribute a lot of that to James actually. I like to cook but I don’t like to do dishes. He doesn’t really like to do either but our routine that we have settled into is that I cook and he cleans up. He ALWAYS makes a point to thank me for making everyone food. In turn, I try to keep up, and make sure he knows I appreciate his cleaning up. We regularly and verbally appreciate the work each other does for our family. We also verbally let each other know when one of us is feeling an imbalance for too long. At some point or another, the kids picked up on it and jumped in.

And we noticed enough to thank them, too!

Together we have all found a rhythm. To continue with the dinner example, we don’t have a kitchen table in the tiny house. We use normal old fold up TV stands. While I am cooking, most nights, the kids will pull out the tables to get ready for dinner. When they are done, they take their dishes to the sink and put away their tables. We’re so in the routine of showing appreciation that we thank them without thinking. And so it became their routine to help clean up in the ways that they can. It really is communication and it happens on a daily basis. Even though we don’t set a chore schedule, they certainly step up and help with chores!

Frankly, my feelings on it is that we had the kids, they don’t OWE us anything. I know chores are a great way to give a sense of purpose and routine in a family but I don’t love the hierarchy of it. Our skillsets aren’t equal. They do what they can, when they can and how they can. There are still a great many things I would prefer they don’t ‘help’ with because it’s not all that helpful to have them do it (like dragging the trash through the kitchen…). But they do willingly do what they can and often, if I have to ask, there isn’t a fit over it, they are pretty happy to jump in and collect the appreciation after.

I can certainly see turbulence there on the horizon with Hazel, as she develops her pre-tween attitude muscles. We’ll see how that plays out. Hopefully it is bearable since we have created an atmosphere of positive reinforcement. Here’s hoping at least!

Allowance

My theory is that I don’t get an allowance and there is nowhere else in life where they will get free money, just for existing. No one pays me for doing the things that need to be done around the house and there are a lot of things that I have to go without on because I have had to define my priorities. It feels like it would be a disservice to give them money just because. I know that an allowance is the main way parents aim to teach their kids about money. It all seems based on such an unrealistic precedent that I have to wonder if it is leading to more of a sense of entitlement rather than fiscal responsibility.

Books

There are plenty of ways that the kids come up with to make money. Aside from watching us and offering to take some of our workload for pay, they always have books. This is an idea that I saw well before I had kids and I thought, “I love this, if I ever have kids I am doing this.” I have waited so long for them to be able and willing to read actual books that this just officially started this year. The idea is that we parents, who can see their path, we see strengths and weaknesses, we can offer outside influences. Because we love and care about them and we have a bit more experience in this life, we can find developmentally correct books to teach them concepts that we can’t necessarily get through to them. We parents pick a book and name the price. They are allowed (and encouraged) to barter that price with us (bartering is SUCH a great money wise skill!).

Once an agreement is made, they read the book and give us a report on what they got from it. That helps inform us about where their head is at, teaches us more about how and what they learn and they get knowledge from other, smarter-than-us people. Right now, Hazel is being paid $5 to read the book “The Confidence Code For Girls” She’ll get $5 more for doing the workbook. (We buy the books for them too of course!).

Miles just got $2 for reading his first chapter book. While he enjoyed it, he said he will be sure to barter the price up on his next book because it took longer than he expected ;-). This side note of life supports our goals of creating lifelong learners.

They are making businesses!

Getting to the meat of our teaching that prompted this post!

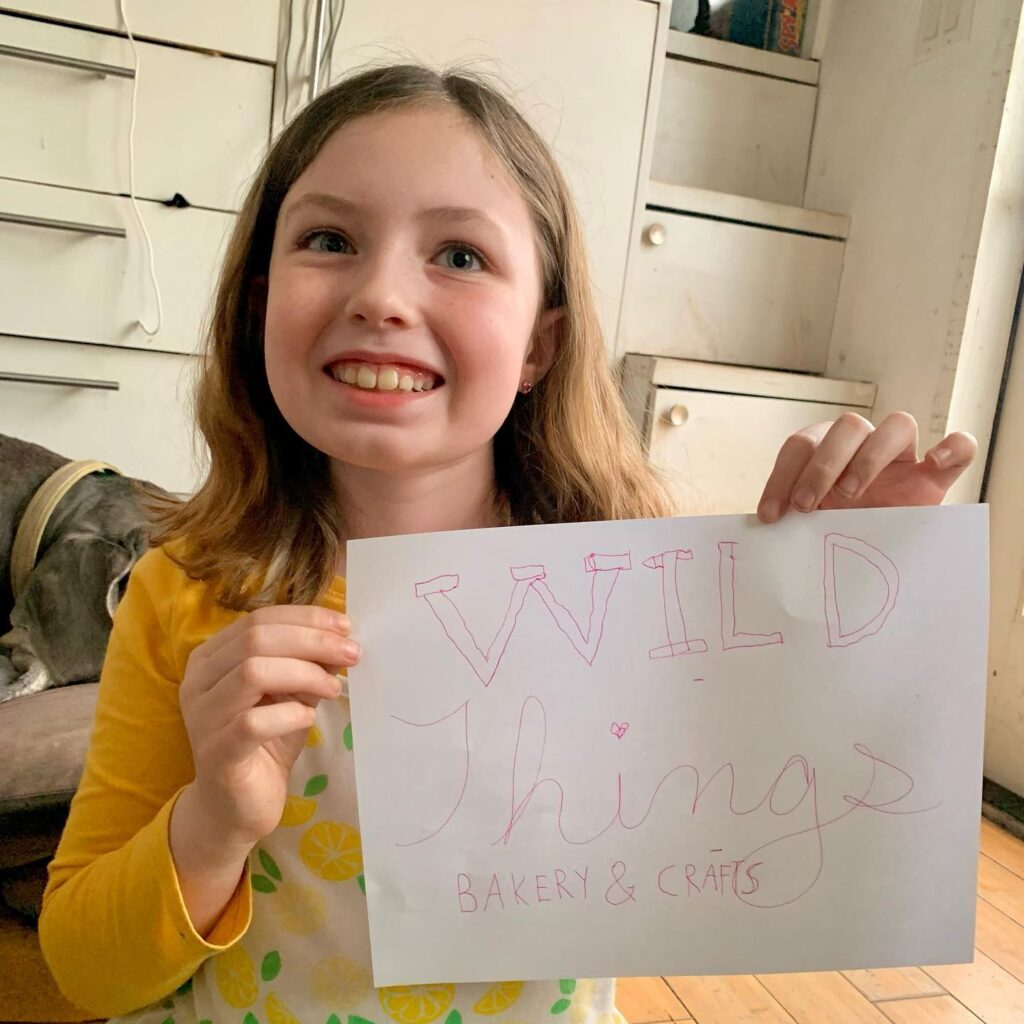

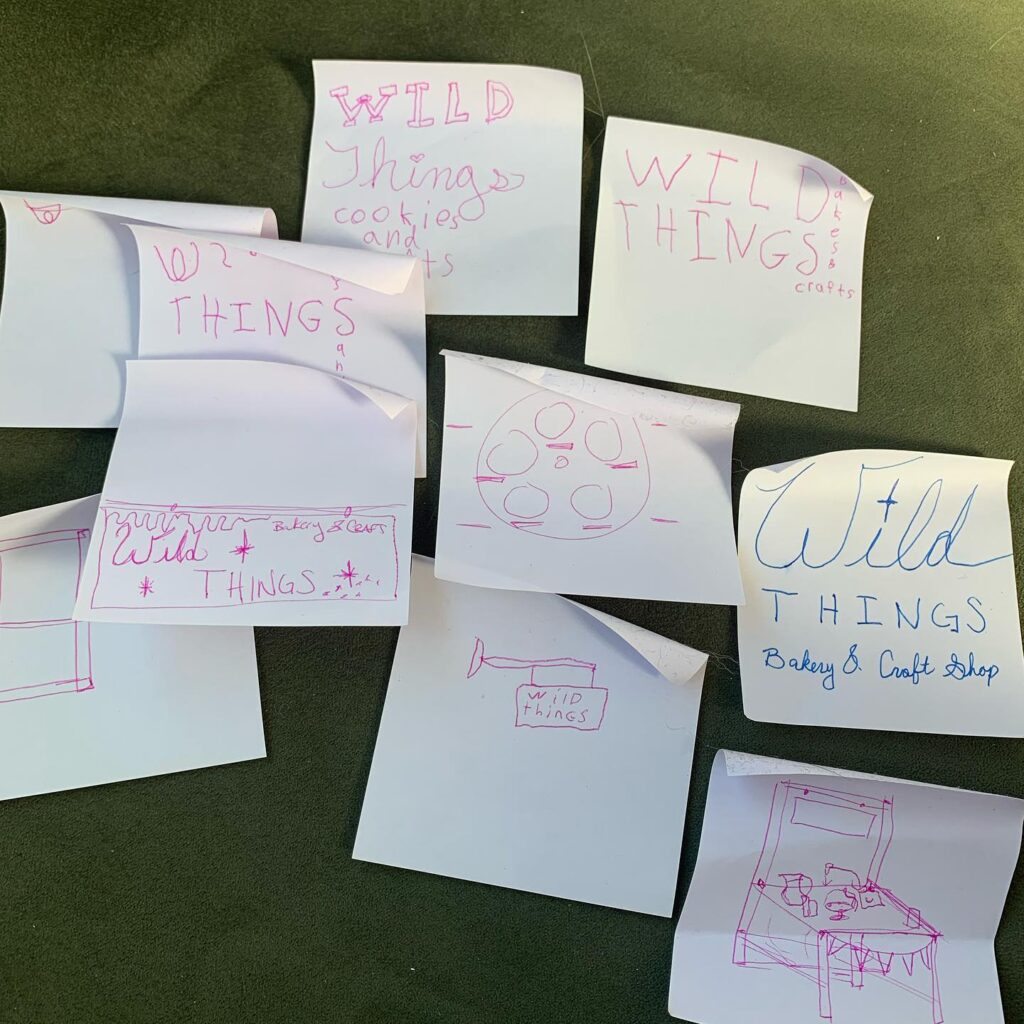

We are a family of entrepreneurs since before I even knew what that word meant. It turns out these kids are a chip off the ole block, times two. Hazel has made the goal to make $1,000 dollars this summer. That’s 500 for her OA, 500 to spend. Miles doesn’t want her to have more money than him, so he is pushing the same goal.

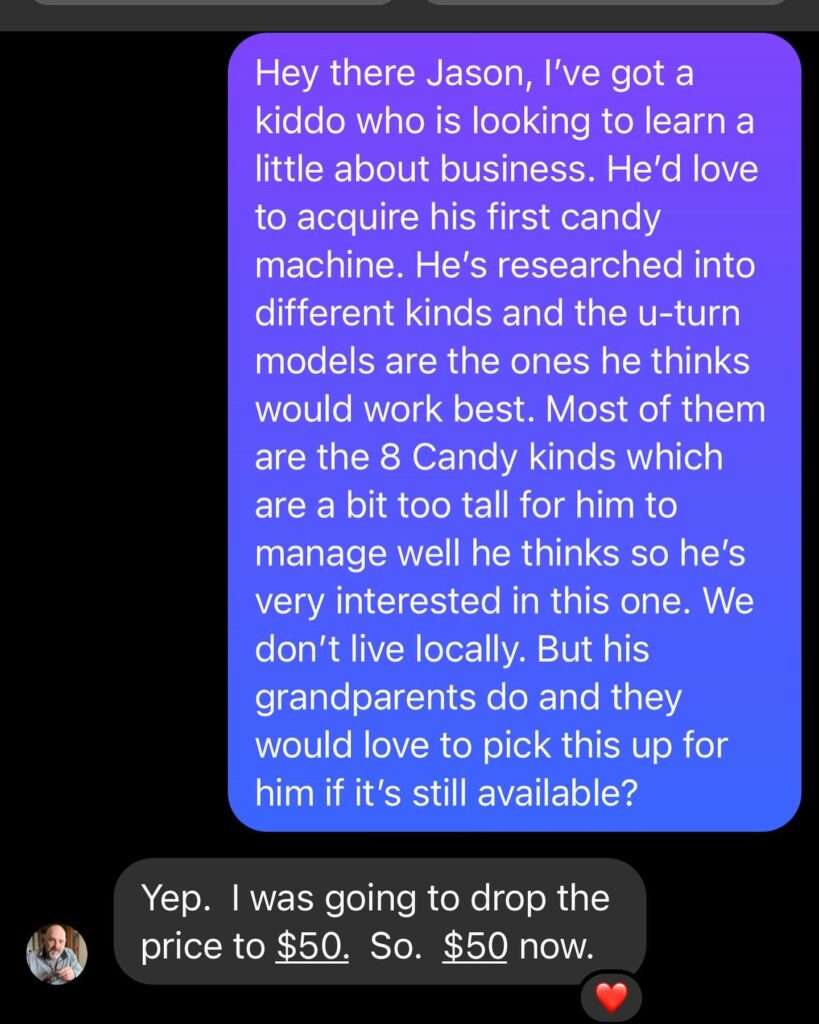

The plan WAS that Hazel would start a cookie business and get a booth at the Farmers Market. Miles wanted to start a candy machine business. They have since joined forces and decided to do both efforts as equal partners. While these were completely their ideas, I’m pretty sure they came from listening to stories of our past. James used to have candy machines, and I used to make cookies.

They are excited for these newest ventures because they finally got permission to withdraw money from their bank. Boy do they walk up to the teller with a swagger! I recognize it as the same one I used to have when my mom made such a big deal about depositing my 5 dollars!

More than just money

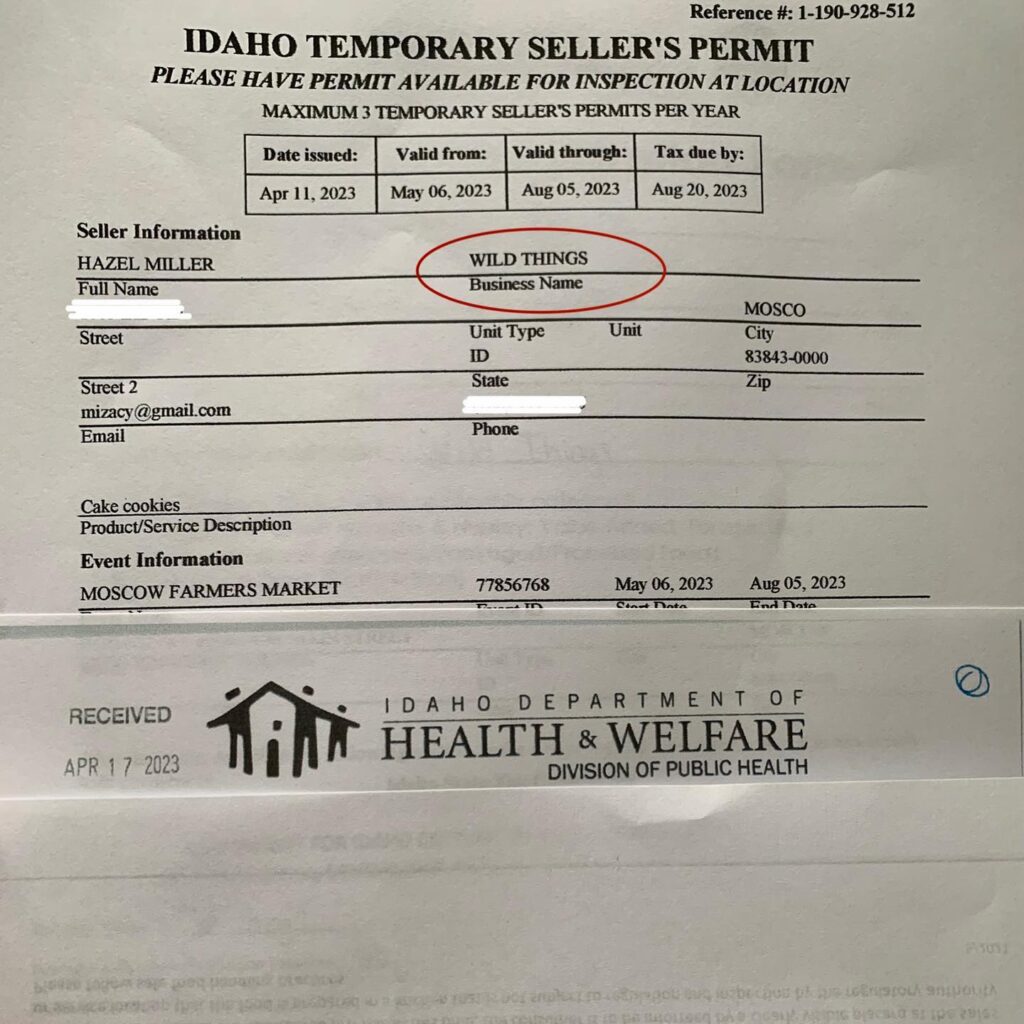

It’s a whole bundle of practical demonstrations. They will learn about loans (and paying themselves back), demonstrating salesmanship, and work on interpersonal skills. There is cost analysis, community outreach, budgeting and reacting to limitations. They have to pay sales tax and had to apply for a cottage food license. Of course the hard work of making the products. There is also a level of confidence required, learning to speak up, make change, take compliments and criticisms. They have had to physically build their booth and we have a meeting to talk to the company who is letting us place their first candy machine today. They are planning to dress to impress and push their comfort zone on speaking up. These are all incredible opportunities that will build through their life.

Right now, they are driving the direction. I am doing a lot of the conversing and paperwork for them in front of their watchful eyes. They are developing the confidence to take it over when they feel ready. Our goal is to teach them to save and spend responsibly along with the joys of having enough mulla for things they want, AND thinking through what they want.

The fist week of the summer and they are $100 dollars closer to their goals!

In the end

I’m almost sure we are ruining them in some way. No one is perfect and we can all only make our next best choice. The thing is though that we all need different things at different points and in different amounts. James and I do the best we can to react to their needs and provide a childhood that we would have benefitted from. When it comes right down to it, they are different people than us. What they need may very well be much, much different than what we are providing. That’s the way life goes.

Wow!

What an article, absolutely important for kids today to know how to spend skillfully regardless of how much they can spare. These thing should be thought at schools actually but that’s a conversation for another day.

Looking forward for more article like this.

Cheers!